Click to Edit

SHARED

SERVICE

CENTER IN SEA

THE REVOLUTION OF

20

23

The COVID-19 pandemic made the business world witness a true example of

why it is important to always have preparedness for the unexpected.

Unquestionably, the challenges of conducting day-to-day business activities

during the pandemic have broadened the horizon of business prospects for

organizations while enabling them to effectively succeed in the new normal.

Today, SSCs signify two key implications for businesses in this post-pandemic

time:

(i)Accelerated digital competencies, and

(ii)Consistency towards working in a relentlessly changing environment.

ELLWOOD CONSULTING

THE REVOLUTION OF SHARED SERVICE CENTER IN SEA

Introduction

Reportedly, the global market of Shared Service Centers (SCCs) is to

acquire growth by USD 123.64 billion between 2021 and 2026, while

maintaining the momentum at a CAGR of 17.77% [1]. Though the

model of SSCs originated in the 1980s, the global-level disruptions

caused by the recent pandemic of COVID-19 have guided significant

reforms in the model.

E

ELLWOOD CONSULTING

THE REVOLUTION OF SHARED SERVICE CENTER IN SEA

E

It is because the pandemic scenario has raised concerns about how

important it is for employees to work productively from their homes in

a seamless manner while serving the organizational objectives. Thus,

the need for building newer capabilities in the existing models of SSCs

is realized, and this justifies the projected growth of the SSCs market in

the post-pandemic scenario (17.7% CAGR during 2021-2026) [1].

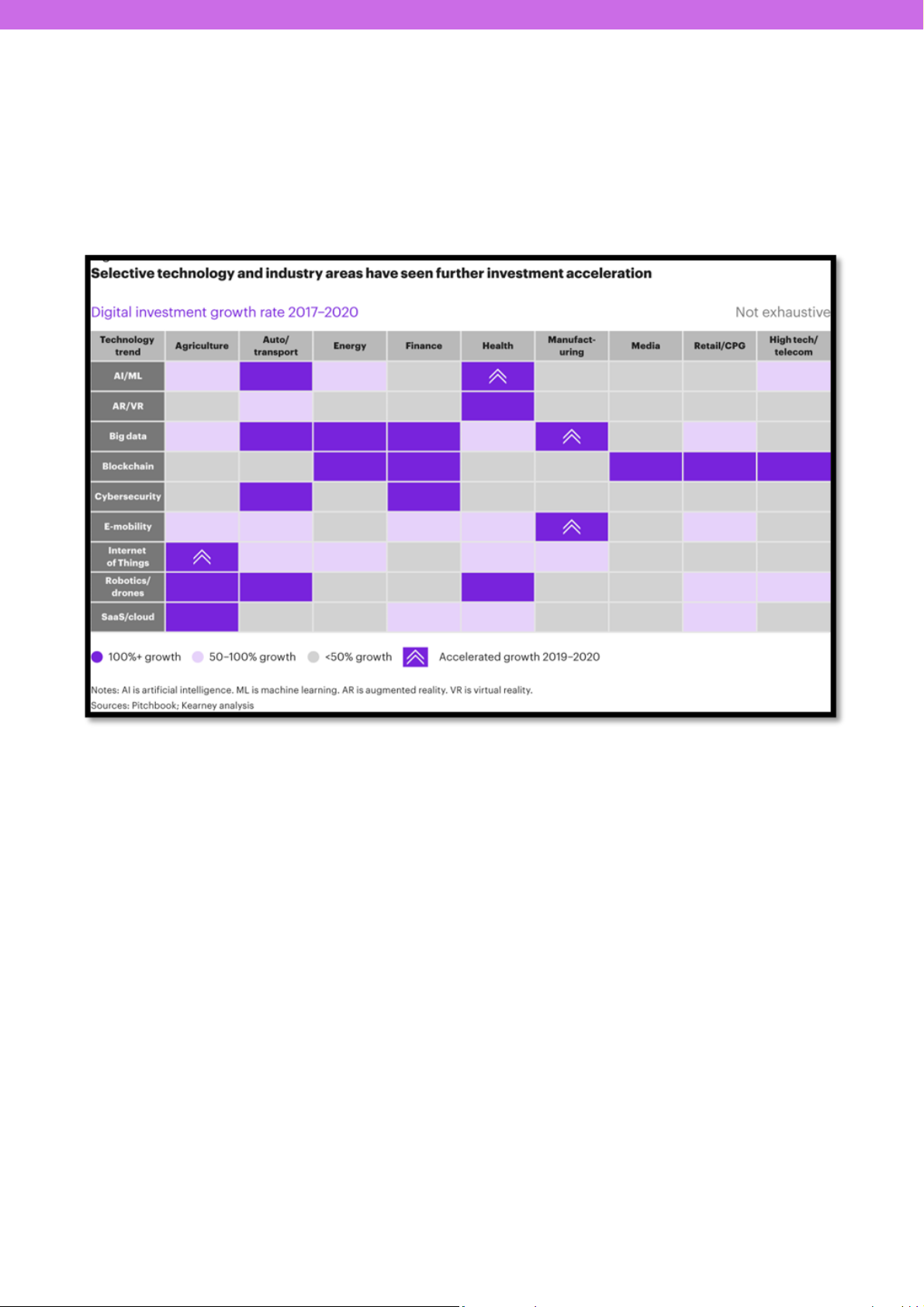

At the same time, it is notified that the increasing demand for digital

competencies is not restricted to the high-tech sector only. Even

though the demand across this sector has been consistently increasing

since the pandemic (increased by 30-50%), the sectors of

manufacturing, agriculture, health, and energy acquired 100% growth

since 2020, and it is expected to greatly accelerate in the next 3-5 years

[2].

The proceeding section underpins key insights into the changing SSCs

market in SEA following COVID-19, specific to the opportunities and

challenges for market expansion in the region.

Figure 1: Accelerated growth of different sectors since the pandemic

Businesses have realized the importance of making shared service centers an

integral part of their plan to keep the operations unaffected or least affected

whether there comes some natural disaster or a pandemic scenario like

COVID-19.

Being specific to Shared Services, it is reported that the majority of the

companies have opted for the Global Business Services (GBS) approach;

focusing on talent management and cost reduction. PWC shares that 44% of

surveyed SSC companies have adopted the GBS approach while over 20%

would have adopted this global business model in the next 5 years [3].

SSCs in the Post-pandemic

business world

The pandemic of COVID-19 has left a lasting

impact on the global business world.

ELLWOOD CONSULTING

THE REVOLUTION OF SHARED SERVICE CENTER IN SEA

What makes these countries the potential landscape for global SSCs is

their bilingual talent pools (proficiency in English communication),

which makes them globally competent [4].

As per the report, India stands as the best location with Chennai, Delhi

and Hyderabad being the top cities for SSC operations. The most

significant factors are the availability of skilled talent and cost-effective

operations that make India an important landscape for global SSCs. The

top areas include financial services, IT services, business support and

contact center functions, as India offers a large talent pool across these

service sectors. For instance, renowned global entities like Shearwater

Health, Barclays, and Cresco Shared Services have already invested in

India’s Pune and in the Philippines’ Cebu. Likewise, Malaysia’s Kuala

Lumpur, Shah Alam and Cyber Jaya, Indonesia’s Jakarta, and the

Philippines’ Makati, Cebu, and Manila are the prime locations for SSCs in

SEA [4].

India, Malaysia and the

Philippines are reported

as the top countries in

Asia for being the ideal

ones for SSC operations

in the region.

ELLWOOD CONSULTING

THE REVOLUTION OF SHARED SERVICE CENTER IN SEA

Opportunities and

challenges for market

expansion in the region

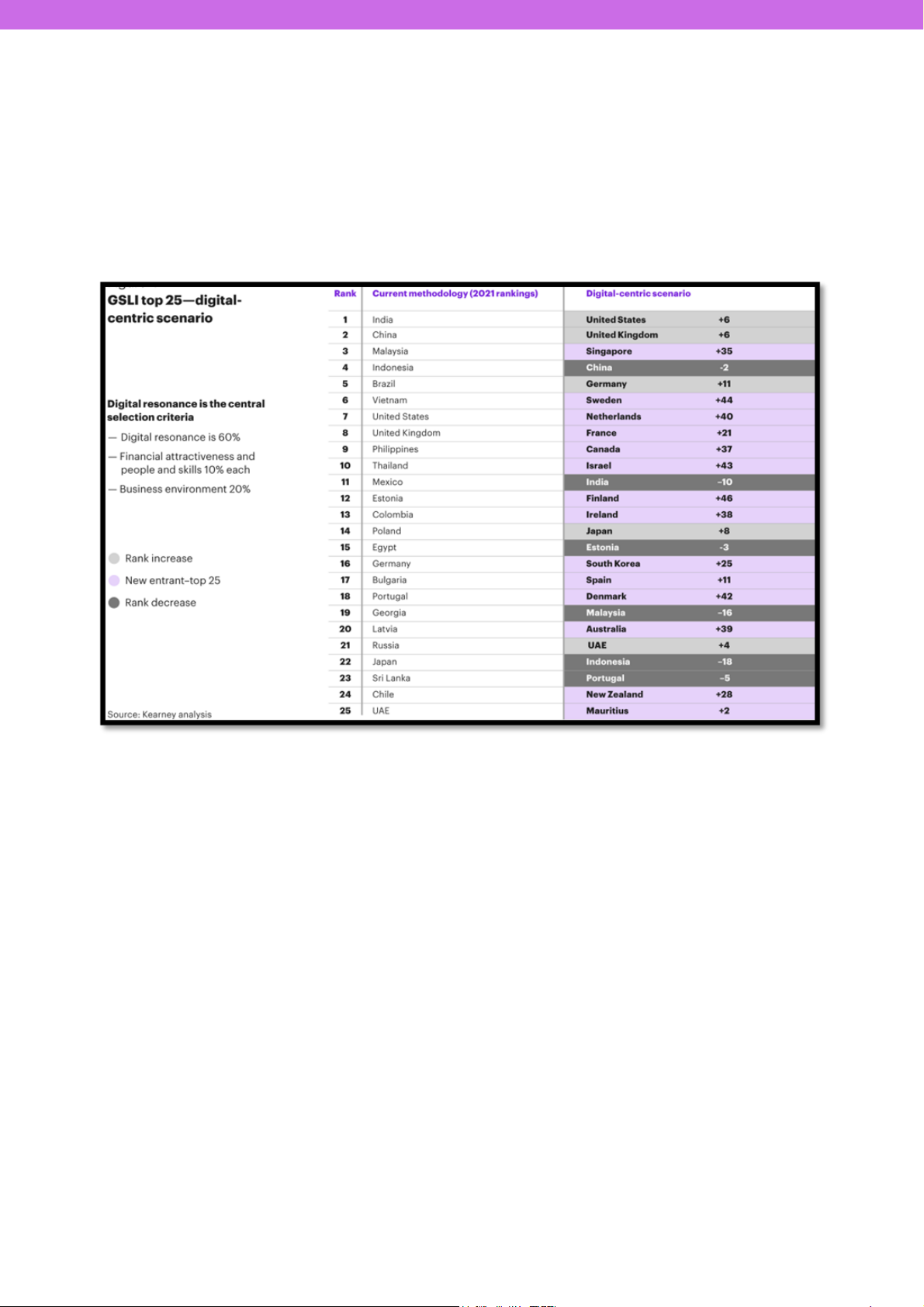

However, based on the GSLI alone, India, Malaysia, Indonesia, Thailand

and Vietnam rank higher. However, these nations’ rank goes down when

the 2019 GSLI indicator of ‘digital resonance’ is taken into consideration.

The figure below illustrates this phenomenon. It is evident how India,

Malaysia, and Indonesia lost their top positions while Vietnam and

Thailand could not even make it to the top 25 [2].

ELLWOOD CONSULTING

THE REVOLUTION OF SHARED SERVICE CENTER IN SEA

Figure 2 – GSLI – digital resonance scenario [2]

Nevertheless, Malaysia manages to stand as a promising location for

SSC setups of global business organizations. 40% of PWC’s surveyed

global businesses are planning to have their SSCs set up in Malaysia.

More fascinating is the horizon of a variety of priorities among these

organizations [3]. For instance, numerous organizations are willing to

expand the horizon of their offerings with their SSCs in Malaysia.

Besides, organizations are also targeting leveraged smart technology

and automation within their existing system in place. Additional is the

motive of facilitating the digitization motives of their companies while

recognizing that their existing talent greatly lacks data analytics and

automation skills.

40% of PWC’s surveyed global businesses are

planning to have their SSCs set up in Malaysia.

Therefore, the young and digitally skilled

demographics of Malaysia greatly attract

SSC companies. Besides the availability of a

highly competent talent pool at competitive

costs, Malaysia offers a robust technological

infrastructure. In this regard, the role of the

Malaysian government is also

commendable. It is specific to the country’s

National 4IR Policy, which signifies the

government’s commitment to strategically

enhancing the nation’s digital infrastructure

through investment projects [5].

Highly competent talent pool at

competitive costs

The role of government also entails the aspect of tax incentives. Malaysia has

signed over 70 treaties on tax and incentives facilitating business around the

globe. Therefore, setting up SSCs in Malaysia is much more feasible for

organizations than ever.

Based on all the initiatives, Malaysia is anticipated to incur 6.2% five-year

compound annual growth by 2025 in the industry of global business services, i.e.,

the industry would hit around 6.7 billion USD. It is in line with the Malaysian

strategy roadmap of 2022-2027, devised and implemented by GBS Malaysia in a

strategic attempt for driving the industry forward.

At the same time, it is also stressed that Malaysia and other SEA countries who

have lost their top positions in GSLI need to attain digital resonance alongside

their financial attractiveness if they anticipate competitiveness in today’s digital-

first world. For instance, there is a need for enhancing the digital adaptability of

their legal system alongside reskilling and upskilling talents (digital skills) [2].

Malaysia is anticipated to incur 6.2%

five-year compound annual growth by 2025

ELLWOOD CONSULTING

THE REVOLUTION OF SHARED SERVICE CENTER IN SEA

Even though the SEA countries are increasingly focused on attaining more

digital resonance while attracting renowned global business entities to invest

in SSCs on their landscapes, Malaysia still holds eminence among other

countries based on its ‘business enabling environment’ or ‘doing business

index’.

As per the World Bank’s statistics, Malaysia has 12th rank over the Doing

Business Index, which supports its standing as a preferred landscape of global

business entities for their SSCs [6].

On the other hand, India, which is typically the potential landscape for global

businesses’ SSCs, is ranked 63 for its business enabling environment [7]. It

implies that Malaysia’s prospects of getting enhanced growth in the SSCs

industry are much higher. In the same manner, Thailand’s 21st rank, Vietnam’s

70th rank, and Indonesia’s 73rd rank leave significant leverage for Malaysia to

outperform in the industry [8][9][10].

SEA countries are increasingly focused on

attaining more digital resonance

ELLWOOD CONSULTING

THE REVOLUTION OF SHARED SERVICE CENTER IN SEA

[1] https://www.technavio.com/report/shared-services-market-industry-analysis

[2] https://www.kearney.com/digital/article/-/insights/the-2021-kearney-global-

services-location-index

[3] pwc.com/my/en/assets/publications/2021/global-business-services-moving-

towards-digitalisation.pdf

[4] https://www.weareams.com/whitepapers/global-shared-service-centre-

locations/

[5] https://www.mida.gov.my/mida-news/the-national-4ir-policy-at-1-

connecting-malaysia-to-the-future/

[6] https://archive.doingbusiness.org/en/data/exploreeconomies/malaysia

[7] https://archive.doingbusiness.org/en/data/exploreeconomies/india

[8]

https://www.doingbusiness.org/content/dam/doingBusiness/country/t/thailan

d/THA.pdf

[9] https://archive.doingbusiness.org/en/data/exploreeconomies/vietnam

[10] https://archive.doingbusiness.org/en/data/exploreeconomies/indonesia

Bibliography

ELLWOOD CONSULTING

THE REVOLUTION OF SHARED SERVICE CENTER IN SEA